February 19, 2010

Retail Sales

Consumers are getting back in the game. Total retail and food sales increased in January by 0.5 percent, seasonally adjusted, while core sales, which exclude autos and gas, rose by 0.6 percent. During the 12 months ending in January, total and core sales increased by 4.7 and 2.0 percent, respectively, with total sales boosted by the cash-for-clunkers program. Nevertheless, total sales remain 6.3 percent below their recent peak, and core sales are still down by 2.2 percent. As the labor market begins to improve, consumers will carefully ramp up their spending, including some purchases that were deferred during the depths of the recession. Consumer spending accounts for about 70 percent of total gross domestic product, so even a sluggish recovery in retail sales will help put a floor under the economy and reduce the chances for a double-dip recession. This will support leasing demand for commercial real estate, particularly shopping centers. Source: Census Bureau, Grubb & Ellis

Consumers are getting back in the game. Total retail and food sales increased in January by 0.5 percent, seasonally adjusted, while core sales, which exclude autos and gas, rose by 0.6 percent. During the 12 months ending in January, total and core sales increased by 4.7 and 2.0 percent, respectively, with total sales boosted by the cash-for-clunkers program. Nevertheless, total sales remain 6.3 percent below their recent peak, and core sales are still down by 2.2 percent. As the labor market begins to improve, consumers will carefully ramp up their spending, including some purchases that were deferred during the depths of the recession. Consumer spending accounts for about 70 percent of total gross domestic product, so even a sluggish recovery in retail sales will help put a floor under the economy and reduce the chances for a double-dip recession. This will support leasing demand for commercial real estate, particularly shopping centers. Source: Census Bureau, Grubb & Ellis

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@mtcommercialre.com OR Joe Cobb at 406.579.2999 or joe.cobb@mtcommercialre.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Retail For Lease, Retail For Sale, Retail Lease |

Market Reports | Tagged: Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Retail For Lease, Retail For Sale, Retail Lease |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 19, 2009

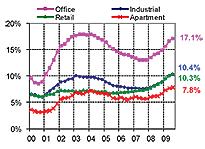

Trade Weighted Exchange Index

Market conditions for the four core property types followed a similar path in the third quarter; vacancy rates increased but not as sharply as in recent quarters. This reflects the improving tone of economic data since last spring and the fact that construction pipelines are emptying. Although Federal Reserve Chairman Ben Bernanke and many other economists think the recession has ended, a leasing market recovery depends on job growth. The last recession ended in November 2001, but payroll employment did not rise above its post-recession level until April 2004 (a 29-month jobless recovery) and did not set a new peak until February 2005 (10 months after that). The recession before that ended in March 1991; the jobless period lasted 14 months, and a new peak was set nine months later. Assuming a jobless recovery of similar magnitude, the labor market would be stagnant until late 2010 and perhaps well into 2011. A jobless recovery of this length seems extreme for the current circumstances, but even so, it appears that leasing markets are unlikely to embark on a meaningful recovery before 2011.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 16, 2009

Elephants and Gorillas

One of the leading indicators of the recovery that we haven’t mentioned is the stock market, perhaps because it is so volatile and covered so thoroughly on a real-time basis. But, like the fabled elephant in the living room or the 500-pound gorilla, we can’t ignore it any longer because the Dow Jones Industrial Average crossed the psychologically important 10,000 threshold on Wednesday. Skeptics will note that the DJIA first crossed 10,000 in 1999, has crossed it 25 times since then and remains 29 percent below its all-time peak in October 2007. But the speed and magnitude of this latest rally merits a sigh of relief at the very least – up 54 percent as of yesterday from its low point on March 9th. The rally has boosted the market for initial public offerings and bond issuance – important sources of capital for many debt-starved companies. Rising equity prices also have helped support business and consumer confidence, which is reflected in two other economic releases this week:

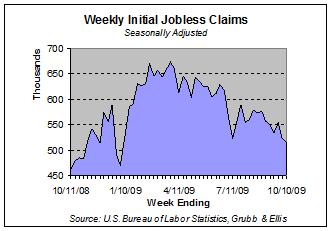

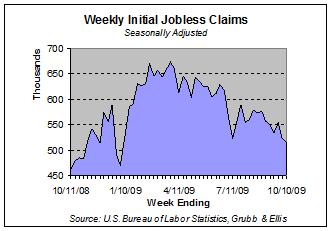

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.- The Census Bureau reported that retail sales overall declined 1.5 percent in September, payback for the 2.2 percent increase in August due to the cash-for-clunkers program. But sales excluding autos and gas, called core retail sales, increased 0.4 percent in September, led by general merchandise stores (up 0.9 percent), food and beverage stores (up 0.7 percent) and clothing and accessories stores (up 0.5 percent). Along with a recent report from the ICSC on chain store sales, this report raises hopes for stable to slightly higher sales in the upcoming holiday season.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 12, 2009

Trade Weighted Exchange Index

Economists are debating whether the falling dollar is helping or hurting the economy. Analysts who are worried (call them the pessimists) think the decline in part reflects doubt that the U.S. government can control long-term deficits. Those who are not worried (the optimists) see the decline as a sign that investors, who fled to U.S. Treasuries when credit markets were in disarray from September through March (driving up the dollar), are regaining their appetite for risk, putting money in stocks, oil and other assets they think will offer better returns. The pessimists fear that the retreat of the dollar, orderly so far, could turn into a rout at some point, forcing the government to pay much higher interest rates to buyers of its debt and sparking inflation. This camp wants the Federal Reserve to begin tightening monetary policy sooner rather than later and the government to control spending, moves that would support the dollar. They are willing to accept a slower recovery in exchange for inflation protection. The optimists think this course of action could repeat the 1930s when premature tightening pushed the economy, which had been recovering rapidly from the 1929-33 collapse, into a second recession in 1937-38. This camp points out that a weak dollar helps U.S. manufacturers by making exports cheaper for overseas buyers. The same dynamic is true for commercial real estate; a weak dollar makes U.S. properties more attractive to foreign investors. Moreover, a little inflation could be helpful for commercial real estate, which could, at some point, reprise its long-dormant role as an inflation hedge. But while a weak dollar might boost the U.S. recovery in the near term, a perennially weak dollar that reflects a lack of faith among investors is not in the best interest of the country or commercial real estate. Eventually the government will need to cut spending, raise taxes or both to control the deficit. Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, State Farm, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, State Farm, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 9, 2009

Second Derivative (ugh!)

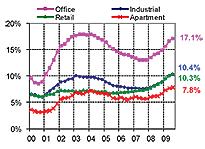

Smart Money called “second derivative” one of those “needlessly nerdy financial words.” In the context of the recession, it means that conditions are still getting worse but at a slowing rate – a prelude to bottoming out. A number of economic indicators have seen improvement in their second derivatives and some are signaling expansion. But because commercial real estate is a lagging indicator, we haven’t seen second derivative improvement… until now.

Preliminary third quarter data from Grubb & Ellis show an abatement in the pace of deterioration compared with the past two quarters. The national office vacancy rate appears to be about 50 basis points higher than in the second quarter, which would take it to just above 17 percent. By comparison, vacancy in the first and second quarters increased by 80 and 100 basis points, respectively. Negative net absorption and sublease space also appear to be moderating. What could explain this slowdown in the rate of decline? One theory is that panicked employers “over-fired” after the credit markets froze in September 2008. The faster deterioration in the leasing market during the first and second quarters likely reflected this panic. Now that the recession appears to be ending, tenants may feel less of a need to further slash their space requirements, although we won’t see positive absorption until job growth returns.

A couple of other notable data releases this week:

- The Labor Department reported that initial jobless claims fell 33,000 to 521,000 last week, beating analyst expectations. The decline, which was the fourth in the past five weeks, brought the four-week moving average to its lowest level since January 17th. Continuing claims for the previous week slipped by 72,000 to 6.04 million.

- Chain store sales rose 0.1 percent in September according to ICSC, the first increase since July 2008. The increase was driven more by calendar and weather effects than by underlying strength in spending, but we’ll take what we can get.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

August 10, 2009

Good News Monday?!?

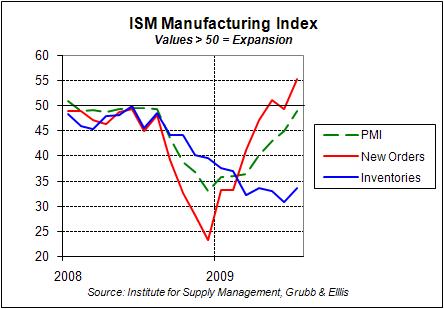

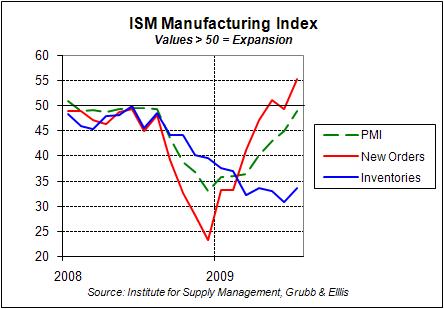

ISM Manufacturing Index

The Institute for Supply Management’s purchasing managers index kept its string of monthly increases this year intact, rising to 48.9 in July. (Values above 50 indicate that the sector is expanding.) Details of the report were encouraging. New orders rose above 50 even as businesses continued to liquidate excess inventories, suggesting that manufacturers will need to ramp up hiring and production in the near term. The gap between new orders and inventories is at its highest level since April 2004. Production has already risen to 57.9, and the employment index, though still below 50, has risen to 45.6, a sign that the long slide in manufacturing job losses could be winding down. The “cash-for-clunkers” program and a recent turnaround in exports are contributing to the improvement. A recovery in the manufacturing sector is good news not only for manufacturing properties, it translates into more goods flowing through corporate supply chains, which will support demand for warehouse/distribution space. Source: Robert Bach, SVP, Chief Economist, Grubb & Ellis

For a free comsultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

July 31, 2009

Gimme Shelter

The housing market grabbed attention this week as the latest indicator to suggest the economy is at or near the bottom.

- The closely watched Standard & Poor’s/Case-Shiller 20-city home price index reported a 0.5 percent gain in the

average price of a single-family home from April to May, the first increase in 34 months. Prices in 15 of the 20 cities in the survey increased or remained stable. On a seasonally adjusted basis, the composite price fell 0.2 percent, the smallest decline in 27 months. (The index is based on a three-month moving average, i.e. the three months ending in May compared with the three months ending in April.)

average price of a single-family home from April to May, the first increase in 34 months. Prices in 15 of the 20 cities in the survey increased or remained stable. On a seasonally adjusted basis, the composite price fell 0.2 percent, the smallest decline in 27 months. (The index is based on a three-month moving average, i.e. the three months ending in May compared with the three months ending in April.)

- Existing home sales in June rose to an annualized rate of 4.89 million, the third consecutive monthly gain according to the National Association of Realtors. The months’ supply of available inventory on the market fell to 9.4 from a peak of 11 months one year ago.

- New home sales also increased for a third consecutive month, rising to an annualized pace of 384,000 in June according to the Census Bureau. After peaking in January at 12.4, the months’ supply has fallen to 8.8.

- Housing starts jumped 3.6 percent in June to an annualized rate of 582,000, the fastest pace since November. Although construction remains weak, it’s another sign that the market is stabilizing.

The housing slide triggered the credit crisis and the recession, and a housing recovery is necessary for the economy to grow again. Recent news suggests this is beginning to happen.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Commercial Real Estate, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Downtown Bozeman, Grubb & Ellis, Grubb & Ellis Releases 2009 Commercial Real Estate Forecast, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate |

Market Reports | Tagged: Belgrade Commercial Real Estate, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Downtown Bozeman, Grubb & Ellis, Grubb & Ellis Releases 2009 Commercial Real Estate Forecast, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

January 5, 2009

Grubb & Ellis released it’s 2009 Commercial Real Estate Forecast today. Grubb & Ellis provides real estate market information for more than 100 local markets throughout North America. Use the link below for complete reports on your market of interest including overviews for office, retail, industrial, multi-family, land, and investments. Click here for the 2009 Forecast: http://www.mtcommercialre.com/pdf/Real-Estate-Market-Forecast-2009-Press-Release.pdf For more information on the Montana Commercial Real Estate Market please contact Sean Thompson @ 406.539.0082 OR Joe Cobb @ 406.579.2999 or visit our website at www.MTcommercialRE.com.

Leave a Comment » |

Leave a Comment » |  Bozeman, Bozeman Real Estate, Commercial Real Estate Bozeman, Montana Commercial Real Estate, Uncategorized | Tagged: Bozeman Business, Bozeman Commercial Land, Bozeman Office, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate Forecast, Grubb & Ellis, Grubb & Ellis Releases 2009 Commercial Real Estate Forecast, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Office For Lease, Office For Sale, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Bozeman, Bozeman Real Estate, Commercial Real Estate Bozeman, Montana Commercial Real Estate, Uncategorized | Tagged: Bozeman Business, Bozeman Commercial Land, Bozeman Office, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate Forecast, Grubb & Ellis, Grubb & Ellis Releases 2009 Commercial Real Estate Forecast, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Office For Lease, Office For Sale, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

Consumers are getting back in the game. Total retail and food sales increased in January by 0.5 percent, seasonally adjusted, while core sales, which exclude autos and gas, rose by 0.6 percent. During the 12 months ending in January, total and core sales increased by 4.7 and 2.0 percent, respectively, with total sales boosted by the cash-for-clunkers program. Nevertheless, total sales remain 6.3 percent below their recent peak, and core sales are still down by 2.2 percent. As the labor market begins to improve, consumers will carefully ramp up their spending, including some purchases that were deferred during the depths of the recession. Consumer spending accounts for about 70 percent of total gross domestic product, so even a sluggish recovery in retail sales will help put a floor under the economy and reduce the chances for a double-dip recession. This will support leasing demand for commercial real estate, particularly shopping centers. Source: Census Bureau, Grubb & Ellis

Consumers are getting back in the game. Total retail and food sales increased in January by 0.5 percent, seasonally adjusted, while core sales, which exclude autos and gas, rose by 0.6 percent. During the 12 months ending in January, total and core sales increased by 4.7 and 2.0 percent, respectively, with total sales boosted by the cash-for-clunkers program. Nevertheless, total sales remain 6.3 percent below their recent peak, and core sales are still down by 2.2 percent. As the labor market begins to improve, consumers will carefully ramp up their spending, including some purchases that were deferred during the depths of the recession. Consumer spending accounts for about 70 percent of total gross domestic product, so even a sluggish recovery in retail sales will help put a floor under the economy and reduce the chances for a double-dip recession. This will support leasing demand for commercial real estate, particularly shopping centers. Source: Census Bureau, Grubb & Ellis

Posted by Sean Thompson

Posted by Sean Thompson

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.

average price of a single-family home from April to May, the first increase in 34 months. Prices in 15 of the 20 cities in the survey increased or remained stable. On a seasonally adjusted basis, the composite price fell 0.2 percent, the smallest decline in 27 months. (The index is based on a three-month moving average, i.e. the three months ending in May compared with the three months ending in April.)

average price of a single-family home from April to May, the first increase in 34 months. Prices in 15 of the 20 cities in the survey increased or remained stable. On a seasonally adjusted basis, the composite price fell 0.2 percent, the smallest decline in 27 months. (The index is based on a three-month moving average, i.e. the three months ending in May compared with the three months ending in April.)