January 22, 2010

Signs of a Market Bottom…

Office and industrial vacancy rates increased every quarter last year, but the rate of increase declined as the year progressed. In the four quarters of 2009, office vacancy increased sequentially by 80, 100, 50 and 30 basis points while industrial vacancy increased by 70, 60, 30 and 20 basis points. Absorption followed a similar trajectory: Totals were negative every quarter last year, but fourth quarter losses were the shallowest.

We are hearing about other signs of a market bottom:

This could be the year of the long-term lease, replacing the one-year extensions prevalent in 2009. Tenants whose leases expired last year shied away from new long-term commitments given the bleak outlook. But the economy has started to grow again, and profits held up remarkably well through the recession thanks to corporate cost-cutting measures including employee layoffs. Tenants are becoming confident enough to lock in the great deals on offer from landlords.

This could be the year of the long-term lease, replacing the one-year extensions prevalent in 2009. Tenants whose leases expired last year shied away from new long-term commitments given the bleak outlook. But the economy has started to grow again, and profits held up remarkably well through the recession thanks to corporate cost-cutting measures including employee layoffs. Tenants are becoming confident enough to lock in the great deals on offer from landlords. - Tenants’ top priority last year was getting the cheapest space, but many tenants are becoming receptive to upgrading their space, i.e. willing to pay a little more for better space. In the retail market, some tenants were shut out of the best locations during the boom. But vacancies have opened up even in the best centers, and retailers are looking at upgrading their locations.

- In a few markets, landlord psychology is beginning to shift. The office vacancy rate continues to rise in San Francisco, but some property owners have reduced their concession packages, believing the worst has passed.

- Industrial brokers in some locations including Tampa and Columbus are reporting increasing activity by tenants looking to take advantage of very low rental rates.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@mtcommercialre.com OR Joe Cobb at 406.579.2999 or joe.cobb@mtcommercialre.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Commercial Real Estate Forecast, Grubb & Ellis, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Commercial Real Estate Forecast, Grubb & Ellis, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

January 19, 2010

Commercial Real Estate Vacancy Rates

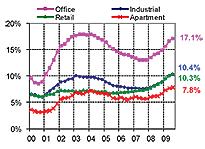

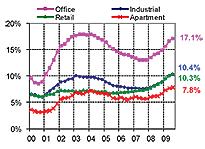

The average U.S. vacancy rates for the four core property types – office, industrial, retail and apartment – continued to rise in the fourth quarter, but the rate of increase slowed for office and industrial. Vacancy rates last quarter increased by 30 basis points for office and 20 basis points for industrial compared with third-quarter gains of 50 and 30 basis points, respectively. This raises the possibility that the office and industrial leasing markets may bottom out as early as mid-year with modest, positive absorption possible in the second half of 2010. In the office market, a prerequisite for this relatively early bottoming would be for employers to begin adding jobs in the first half of this year, which would also provide support for the apartment and retail markets. For the industrial market, continued improvement in the drivers of demand for industrial space – production activity, freight shipments and global trade – would help the market bottom out around mid-year. Source: Reis, Grubb & Ellis

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@mtcommercialre.com OR Joe Cobb at 406.579.2999 or joe.cobb@mtcommercialre.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

January 11, 2010

Commercial RE Loans at Commercial Banks

Percentage of All Bank Loans and Leases, November 2009

Commercial real estate loans accounted for 24 percent of all loans and leases at commercial banks in the U.S. as of November. The Federal Reserve defines these to include “construction, land development, and other land loans, and loans secured by farmland, multifamily (5 or more) residential properties, and nonfarm nonresidential properties.” Large domestically chartered banks – the 25 largest in terms of domestic assets – held 17 percent of their loans and leases in commercial real estate while small domestically chartered banks held 41 percent in this category. The preponderance of commercial real estate loans at small banks suggests more failures to come as distressed assets continue to accumulate. Moreover, small banks lend to small businesses, which are job incubators; commercial real estate loan problems at small banks could impinge upon their ability to lend, which could dampen the labor market recovery. Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Montana Business, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Montana Business, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

December 28, 2009

Home Sales In Millions. Source: Census Bureau, National Association of Realtors, Grubb & Ellis

Sales trends for new and existing homes parted company in November. The National Association of Realtors reported that existing home sales rose 7.4 percent from October to a seasonally adjusted annual rate of 6.54 million units, the highest level since February 2007. Meanwhile, the Census Bureau reported that new home sales sank to a seasonally adjusted annual rate of 355,000 units, down 11.3 percent from October and the weakest level in seven months. Sales of foreclosed and other distressed properties are inflating existing home sales at the expense of new home sales, having accounted for 33 percent of existing sales last month. The tax credit for first-time buyers, which was set to expire at the end of November, helped both new and existing home sales. But new home sales are counted when the sales contract is signed or a deposit is accepted while existing home sales are counted when the sale is closed, meaning that new home sales attributable to the tax credit likely showed up earlier in the data. The extension of the tax credit through April 2010 and its expansion to include some repeat buyers will provide a boost to home sales as the spring selling season gets underway. Besides ending the tax credit next year, the government will wind down its purchases of mortgage-backed securities, which has helped keep mortgage rates low. The withdrawal of these support programs will be a test to see if the housing market can continue to recover on its own or whether there could be another leg down in prices as foreclosures continue to mount. Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.299 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Commercial Real Estate Forecast, Grubb & Ellis, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Commercial Real Estate Forecast, Grubb & Ellis, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

December 18, 2009

Concluding Thoughts for 2009

Economic downturns can be an opportunity for savvy businesses to grab market share according to a story this week on NPR’s Morning Edition (click here to listen). The story notes that company market shares change more during a downturn than at any other time.

But this downturn is coming to a close. Former Federal Reserve Chairman Alan Greenspan, appearing on Meet the Press last Sunday, said that the recession probably ended in July or even in June. He went on to say that employers “presumed that the economy was going to go down far more sharply than it actually did… What this means is that we have a level of employment at this stage which is barely adequate to staff the level of output, and… it seems to me virtually inevitable that if nothing else were to happen that employment would start to come back fairly quickly.”

Alan Blinder, professor of economics and public affairs at Princeton University and a former vice chairman of the Federal Reserve Board, makes the same point in an op-ed article in The Wall Street Journal this week titled “The Case for Optimism on the Economy” (click here). He notes that “Fearful businesses pared payrolls to the bone… Which means that firms will need to hire more workers as their sales and production grow. Which means that employment may start growing sooner than the pessimists think.”

This is the 39th edition of Good News Friday. The first one came out on Friday, March 20th during the depths of the credit crisis and the recession. But we were already past the low point. The Dow Jones Industrial Average hit bottom on March 9th and embarked on what turned out to be a 57 percent rally as of yesterday, while net monthly job losses had peaked at 741,000 in January and were down just about every month since then, to 11,000 last month. Problems remain, of course, but the economy proved to be far more resilient than just about anyone thought.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

November 30, 2009

Industrial Vacancy vs. Warehouse Rent*

The drivers of demand for industrial space are beginning to firm: global trade, freight transportation, manufacturing activity and retail sales all seem to have hit bottom and either leveled out or posted slight gains recently. But the pending recovery is not yet strong enough to reverse the slide in occupier demand for industrial space. Expect the leasing market to soften further in 2010 with the vacancy rate hitting a peak of 11.4 percent by year end, a percentage point above its 2009-Q3 reading. The asking rental rate for warehouse/distribution space is projected to fall another 5 percent in 2010. In 2011, the vacancy rate should begin a slow descent while rent may slide another 2 percent due to the lingering excess of available space. The signs of improvement are there, but the recovery will be slow. Courtesy of Robert Bach, Chief Economist, SVP, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Forecast, Grubb & Ellis, Market Reports, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Forecast, Grubb & Ellis, Market Reports, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

November 20, 2009

The Elevator Speech

Lately I’ve been speaking a lot to clients and professional groups about the outlook for 2010. Sometimes people buttonhole me as I get my coffee or wait for the presentation to begin. It often sounds like this: “So, are you going to give us some good news today?” This is delivered with a hint of sarcasm because they don’t expect good news from an economist, but they do want to know the bottom line. At Grubb & Ellis, we call this the elevator speech, when a client asks for our view of the market in less than a minute – the length of an elevator ride.

Here is my elevator speech: The recession is over, but 2010 is not going to feel like a classic recovery. There are too many headwinds, notably lagging job creation, lingering weakness in consumer spending and tight lending conditions. But we will see more decisions made by tenants, landlords, buyers, sellers and lenders. Keep in mind that Depression 2.0, a latter-day version of what the world endured in the 1930s, was still on the table through the first few months of this year, which made everyone freeze in place. Next year will bring more clarity and with it an increase in leasing and investment transactions. It won’t be pretty, but we are likely to see more results from our efforts.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Montana Business, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Montana Business, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 19, 2009

Trade Weighted Exchange Index

Market conditions for the four core property types followed a similar path in the third quarter; vacancy rates increased but not as sharply as in recent quarters. This reflects the improving tone of economic data since last spring and the fact that construction pipelines are emptying. Although Federal Reserve Chairman Ben Bernanke and many other economists think the recession has ended, a leasing market recovery depends on job growth. The last recession ended in November 2001, but payroll employment did not rise above its post-recession level until April 2004 (a 29-month jobless recovery) and did not set a new peak until February 2005 (10 months after that). The recession before that ended in March 1991; the jobless period lasted 14 months, and a new peak was set nine months later. Assuming a jobless recovery of similar magnitude, the labor market would be stagnant until late 2010 and perhaps well into 2011. A jobless recovery of this length seems extreme for the current circumstances, but even so, it appears that leasing markets are unlikely to embark on a meaningful recovery before 2011.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 16, 2009

Elephants and Gorillas

One of the leading indicators of the recovery that we haven’t mentioned is the stock market, perhaps because it is so volatile and covered so thoroughly on a real-time basis. But, like the fabled elephant in the living room or the 500-pound gorilla, we can’t ignore it any longer because the Dow Jones Industrial Average crossed the psychologically important 10,000 threshold on Wednesday. Skeptics will note that the DJIA first crossed 10,000 in 1999, has crossed it 25 times since then and remains 29 percent below its all-time peak in October 2007. But the speed and magnitude of this latest rally merits a sigh of relief at the very least – up 54 percent as of yesterday from its low point on March 9th. The rally has boosted the market for initial public offerings and bond issuance – important sources of capital for many debt-starved companies. Rising equity prices also have helped support business and consumer confidence, which is reflected in two other economic releases this week:

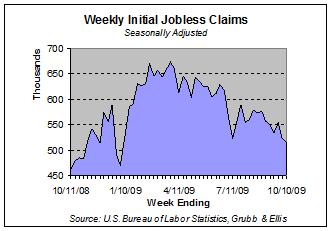

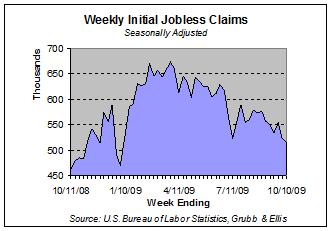

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.- The Census Bureau reported that retail sales overall declined 1.5 percent in September, payback for the 2.2 percent increase in August due to the cash-for-clunkers program. But sales excluding autos and gas, called core retail sales, increased 0.4 percent in September, led by general merchandise stores (up 0.9 percent), food and beverage stores (up 0.7 percent) and clothing and accessories stores (up 0.5 percent). Along with a recent report from the ICSC on chain store sales, this report raises hopes for stable to slightly higher sales in the upcoming holiday season.

Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Land, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

October 12, 2009

Trade Weighted Exchange Index

Economists are debating whether the falling dollar is helping or hurting the economy. Analysts who are worried (call them the pessimists) think the decline in part reflects doubt that the U.S. government can control long-term deficits. Those who are not worried (the optimists) see the decline as a sign that investors, who fled to U.S. Treasuries when credit markets were in disarray from September through March (driving up the dollar), are regaining their appetite for risk, putting money in stocks, oil and other assets they think will offer better returns. The pessimists fear that the retreat of the dollar, orderly so far, could turn into a rout at some point, forcing the government to pay much higher interest rates to buyers of its debt and sparking inflation. This camp wants the Federal Reserve to begin tightening monetary policy sooner rather than later and the government to control spending, moves that would support the dollar. They are willing to accept a slower recovery in exchange for inflation protection. The optimists think this course of action could repeat the 1930s when premature tightening pushed the economy, which had been recovering rapidly from the 1929-33 collapse, into a second recession in 1937-38. This camp points out that a weak dollar helps U.S. manufacturers by making exports cheaper for overseas buyers. The same dynamic is true for commercial real estate; a weak dollar makes U.S. properties more attractive to foreign investors. Moreover, a little inflation could be helpful for commercial real estate, which could, at some point, reprise its long-dormant role as an inflation hedge. But while a weak dollar might boost the U.S. recovery in the near term, a perennially weak dollar that reflects a lack of faith among investors is not in the best interest of the country or commercial real estate. Eventually the government will need to cut spending, raise taxes or both to control the deficit. Courtesy of Robert Bach, SVP, Chief Economist, Grubb & Ellis.

For a free consultation of your commercial real estate needs please contact Sean Thompson at 406.539.0082 or sean.thompson@grubb-ellis.com OR Joe Cobb at 406.579.2999 or joe.cobb@grubb-ellis.com. www.MTcommercialRE.com

Leave a Comment » |

Leave a Comment » |  Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, State Farm, Warehouse For Lease, Warehouse For Sale |

Market Reports | Tagged: Belgrade Buisness, Belgrade Commercial Real Estate, Belgrade Office, Bozeman, Bozeman Business, Bozeman Commercial Real Estate, Bozeman Office, Bozeman Real Estate, Bozeman Retail, Bozeman Warehouse, Commercial Investment, Commercial Land, Commercial Real Estate, Commercial Real Estate Bozeman, Grubb & Ellis, Investment Property, Montana Business, Montana Commercial, Montana Commercial Real Estate, Montana Real Estate, Office For Lease, Office For Sale, Retail For Lease, Retail For Sale, Retail Lease, State Farm, Warehouse For Lease, Warehouse For Sale |  Permalink

Permalink

Posted by Sean Thompson

Posted by Sean Thompson

This could be the year of the long-term lease, replacing the one-year extensions prevalent in 2009. Tenants whose leases expired last year shied away from new long-term commitments given the bleak outlook. But the economy has started to grow again, and profits held up remarkably well through the recession thanks to corporate cost-cutting measures including employee layoffs. Tenants are becoming confident enough to lock in the great deals on offer from landlords.

This could be the year of the long-term lease, replacing the one-year extensions prevalent in 2009. Tenants whose leases expired last year shied away from new long-term commitments given the bleak outlook. But the economy has started to grow again, and profits held up remarkably well through the recession thanks to corporate cost-cutting measures including employee layoffs. Tenants are becoming confident enough to lock in the great deals on offer from landlords.

Posted by Sean Thompson

Posted by Sean Thompson

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.

Initial claims for unemployment benefits fell by 10,000 to 514,000 for the week ending October 10th. It was the lowest level since the holiday week of January 3rd according to the Bureau of Labor Statistics.